October 30, 2023 · 10 min

In recent years, the world of finance and technology has witnessed a remarkable transformation, led by the ascent of digital assets such as cryptocurrencies and non-fungible tokens (NFTs). These digital marvels offer a fresh paradigm for storing and exchanging value, potentially reshaping the way we understand and utilize money. Nevertheless, with this surge in popularity and innovation, we must also grapple with a new set of challenges and vulnerabilities.

These innovative forms of digital value are revolutionizing the way we interact with money. From decentralizing financial systems to redefining ownership and intellectual property, the possibilities are boundless.

Unfortunately, this newfound popularity comes hand-in-hand with an array of new risks. The digital realm is fraught with dangers, and your digital assets are susceptible to theft or loss due to various factors such as hacking, malware, or even human error.

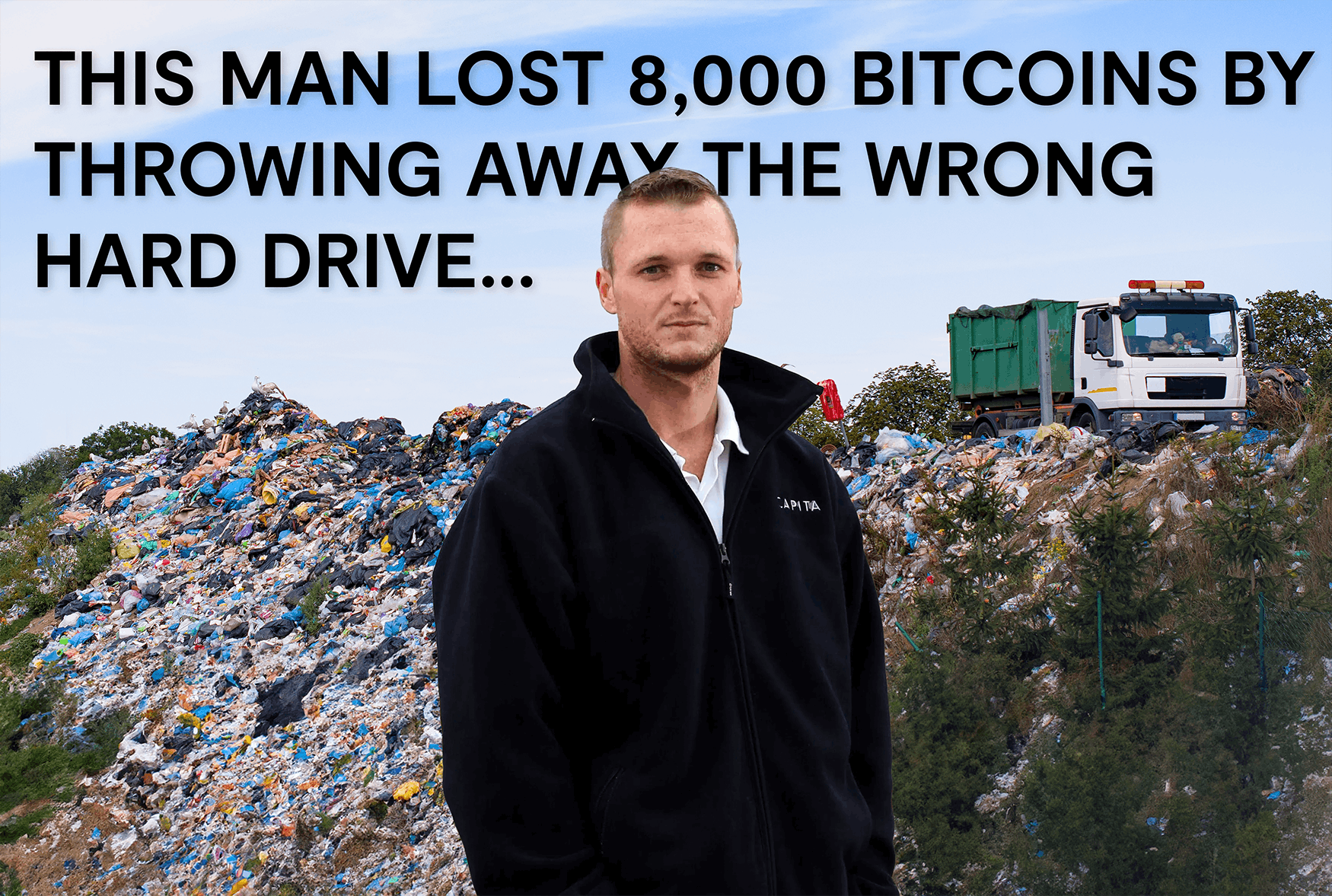

For both seasoned crypto traders and newcomers venturing into this exciting domain, safeguarding your digital assets is paramount. And while it is a benefit to store your assets in a self-custodial wallet, it also brings some responsibility. You most likely remember the stories of early investors throwing away computers, only to find out they threw away the private key or seed phrase as well. There are also investors who never even properly stored the seed phrase, resulting in the loss of an estimated total of 4 million bitcoins.

There are some simple things that you can arrange right away, even before you start acquiring your first bitcoins or other digital assets. Some of them are quick to arrange, others take some time or investment. But they are all worth it and there is not a single best solution. A self-sovereign hodler should always keep on developing and improving its setup. Let's delve deeper into the steps you can take to protect your digital wealth:

Two-factor authentication is your first line of defense. By enabling 2FA on all your accounts, you add an additional layer of security that helps deter unauthorized access. This is mainly for online accounts. While it is commonly accepted to store a small part of your portfolio with third parties or in hot wallets, the majority of your assets should be stored in offline hardware wallets, also known as cold storage.

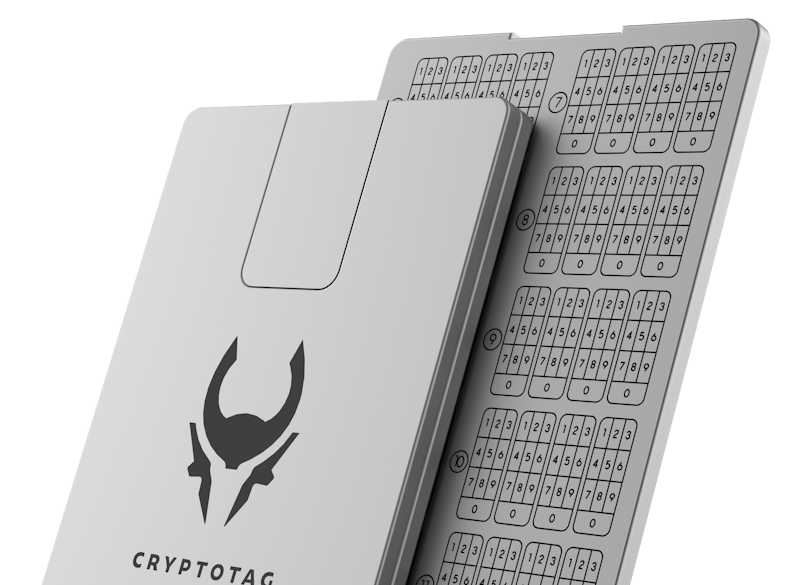

For long-term storage of cryptocurrencies, utilizing a hardware wallet is a must. Additionally, ensure you keep backup copies of your private keys and seed phrases in secure, offline storage. Here, at Cryptotag, we know how important wallet backups are. Have a look in our Shop to see how you can store your seed phrase on bulletproof titanium, that lasts longer than a lifetime.

It is of utmost importance to guard these keys and never reveal them to anyone, even if they claim to represent a legitimate organization.

Pro tip: never store all your eggs in one basket. If you have a significant amount of cryptocurrencies, store them in multiple wallets from different manufacturers. For instance, keep 50% off your portfolio on a Ledger Nano X and 50% on a Trezor Model T.

Regularly updating the software on your devices is crucial for protecting against security vulnerabilities. Hackers are continually devising new methods, and software updates often contain vital security patches.

Strengthen your digital fortress with robust and unique passwords for all your accounts. A password manager can be an invaluable tool for generating and securely storing complex passwords, ensuring the utmost protection. Use unique passwords everywhere. Do not let a database leak ruin your future wealth potential. Once your email address and/or password are known, hackers will try and log into other websites with the known credentials.

For hardware wallets, you can add a Passphrase to your wallet. It is an extra layer of security added on top of the seed phrase. Without the passphrase, a seed phrase is useless and when used to recover a wallet, it will show a totally different wallet than when the passphrase is included in the recovery process. Check out the information for a passphrase on a Ledger or on a Trezor here.

Phishing attacks are a prevalent threat. To shield yourself, verify the sender's email address before opening an email or clicking on any links. Be especially cautious of emails that contain urgent requests or threats, as these are often the tactics of phishing scams.

Never share sensitive information, such as passwords or financial details, in response to an email. Keep an eye out for telltale signs like typos or grammatical errors, as these are common in phishing emails. Furthermore, be wary of emails that ask you to download attachments or install software, as they may contain malware or viruses.

This one seems obvious but is often overlooked. Do not share anything related to your holdings. Not if you hold any coins, and especially nothing about your setup. You do not want to get targeted by hackers, thieves, or robbers.

You can get as paranoid as you want. You can use email providers such as ProtonMail and VPN like Mullvad or ProtonVPN. It’s even better if you self-host instead of using the services of a third party. For every account, you want to have a different email address. Especially for websites with easily identifiable and sensitive information.

Use dummy wallets in case you become the target of a physical attack. You can hand over the wallet or the fake backup without losing the major part of your portfolio.

It is crucial to emphasize that safeguarding your digital assets is not a mere suggestion but a must. The threats of theft and loss, stemming from hacking, malware, or human error are always present. Thus, take the right security measures to ensure your digital wealth remains secure. Even if you think it is not worth it yet, do it. Who knows what the value of your portfolio will be in 2, 5, or 10 years from now?

Now is the time to reflect on your digital asset security. Have you implemented the necessary precautions and protections? Let's make sure you have everything in place.

The best hodl stories, OPSEC tips, and weekly updates of the market.

Weekly hodl insights

Weekly hodl insights Bonus content access

Bonus content access Exclusive offers

Exclusive offers